Introduction to Lab-Grown Diamonds

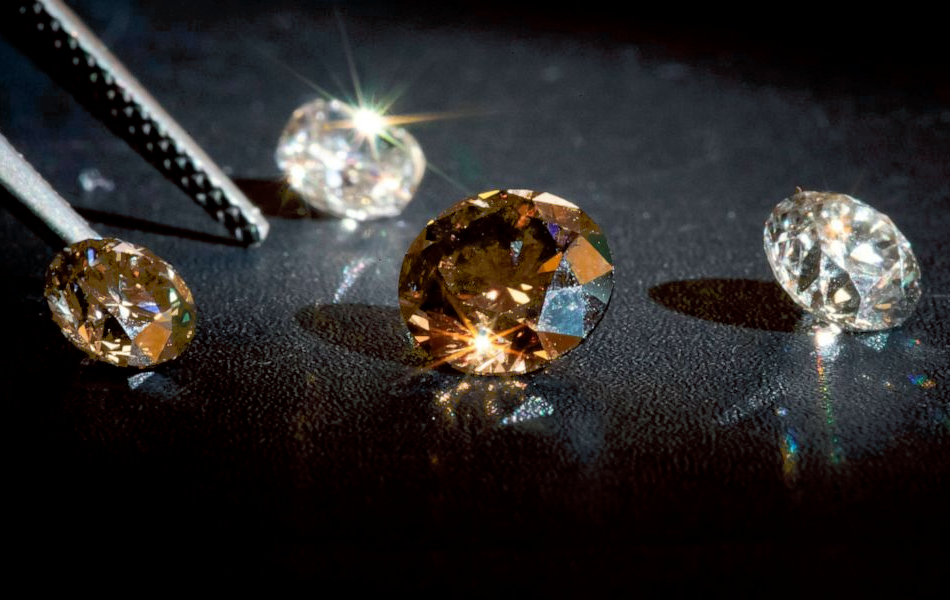

Lab-grown diamonds are making waves in the investment world, but what exactly are they? Imagine a diamond that’s not dug out of the earth but created in a high-tech laboratory instead. That’s the essence of lab-grown diamonds. These sparkling gems are chemically identical to natural diamonds but are produced using advanced technological processes.

What Are Lab-Grown Diamonds?

At their core, lab-grown diamonds are real diamonds. They’re not simulants like cubic zirconia or moissanite but actual investment lab grown diamonds with the same physical and chemical properties as their natural counterparts. The main difference? They’re created in a controlled lab environment rather than forming over millions of years underground.

How Lab-Grown Diamonds Are Made

High Pressure High Temperature (HPHT)

Think of HPHT as the lab’s way of mimicking the natural conditions deep within the Earth where diamonds are formed. This process involves recreating the extreme pressure and temperature found underground, using a diamond seed and carbon to grow a diamond crystal.

Chemical Vapor Deposition (CVD)

CVD is another method where diamonds are grown using a different technique. Imagine a diamond being slowly “painted” layer layer in a vacuum chamber. Carbon-rich gases are used, which, when heated, deposit carbon onto a diamond seed, creating a gem over time.

Why Invest in Lab-Grown Diamonds?

Market Trends and Growth

The market for lab-grown diamonds has been expanding rapidly. Why? They offer a more affordable alternative to natural diamonds while still providing the same level of brilliance and quality. This growth is reflected in the increasing number of retailers and investors jumping on board.

Comparison with Natural Diamonds

Price Stability

Lab-grown diamonds often have more price stability compared to natural diamonds. This is partly because their supply is less subject to the market whims and mining challenges that natural diamonds face. For investors, this can mean fewer surprises and a more predictable investment.

Ethical Considerations

Another major draw is the ethical angle. Lab-grown diamonds eliminate many of the ethical concerns associated with traditional diamond mining, such as conflict diamonds or environmental degradation. This can make them an attractive option for socially-conscious investors.

How to Evaluate Lab-Grown Diamonds for Investment

Understanding Diamond Grading

Before you dive into investing, it’s crucial to understand how lab diamonds are graded. The quality of a diamond is assessed based on the 4 Cs: Cut, Color, Clarity, and Carat weight.

The 4 Cs: Cut, Color, Clarity, and Carat

The cut determines how well the diamond reflects light, the color measures how colorless it is, clarity assesses internal flaws, and carat weight indicates its size. Each of these factors affects the diamond’s overall value and, extension, its investment potential.

Certification and Provenance

Just like natural diamonds, lab-grown diamonds should come with certification from reputable gemological laboratories. This ensures you’re getting what you pay for and helps trace the diamond’s origin, which is important for maintaining investment value.

Long-Term Value and Resale Potential

Lab-grown diamonds are still relatively new in the market, which means their long-term value is somewhat uncertain compared to natural diamonds. However, their increasing acceptance and use could enhance their future resale potential.

Investment Strategies for Lab-Grown Diamonds

Direct Purchase vs. Investment Funds

When it comes to investing in lab-grown diamonds, you have two main routes: direct purchase or through investment funds.

Buying Individual Stones

Investing in individual lab-grown diamonds can be lucrative if you choose high-quality stones. This approach requires a good understanding of diamond grading and market trends to make informed decisions.

Investing in Lab-Grown Diamond Companies

Alternatively, you can invest in companies that produce lab-grown diamonds. This could offer broader exposure to the industry and potentially benefit from the company’s growth and success.

Risk Management and Diversification

As with any investment, risk management is key. Diversifying your investments to include a mix of assets can help mitigate risks associated with lab-grown diamonds. This ensures that if one investment doesn’t perform as expected, others might balance out the potential losses.

Legal and Tax Implications

Understanding Regulations

The regulatory landscape for lab-grown diamonds is still evolving. It’s essential to stay updated on any changes that might affect your investment, such as new labeling requirements or market regulations.

Tax Considerations

Tax implications can also vary depending on your location and how you hold your investment. Consulting with a tax professional can help you understand how to manage your investments in a tax-efficient manner.

The Future of Lab-Grown Diamonds in Investment

Technological Advancements

The future of lab-grown diamonds looks promising, thanks in part to ongoing technological advancements. These innovations are likely to improve the quality and reduce the cost of lab-grown diamonds, further enhancing their investment appeal.

Market Predictions

Experts predict that the market for lab-grown diamonds will continue to grow, driven increasing consumer acceptance and advancements in technology. This growth could potentially offer substantial returns for investors who get in early.

Conclusion

Investing in lab-grown diamonds presents a unique opportunity. With their growing market presence, ethical advantages, and the potential for stable returns, they offer a compelling alternative to traditional diamond investments. As with any investment, thorough research and strategic planning are crucial to making informed decisions. If you’re considering lab-grown diamonds, embrace this innovative field with an eye on market trends and future developments, and you might just find yourself at the forefront of a sparkling new investment frontier.